What should I do with my old 401(k)?

- Frank Iozzo

- Jul 14, 2022

- 2 min read

Determine where your money has the best chance to grow.

KEY TAKEAWAYS

Options for an old Plan: Keep it where it is, bring it with you, or rollover into an IRA.

Know the Plan rules and fees, and compare investment options and expenses.

Find a fiduciary advisor to help you with this decision and going forward.

There are many questions that come with changing jobs or retiring. One of the most common questions is: What should I do with my old retirement Plan? This would include 401(k), 403(b), TSP, and other Plans.

These Plans are usually the largest piece of your retirement savings, but not all Plans are created equal. Every Plan will have different investment options, investment expenses, plan fees, and rules.

It is important to understand your options and weigh the pros and cons in order to find the path that is best for you.

Here are the three options to consider:

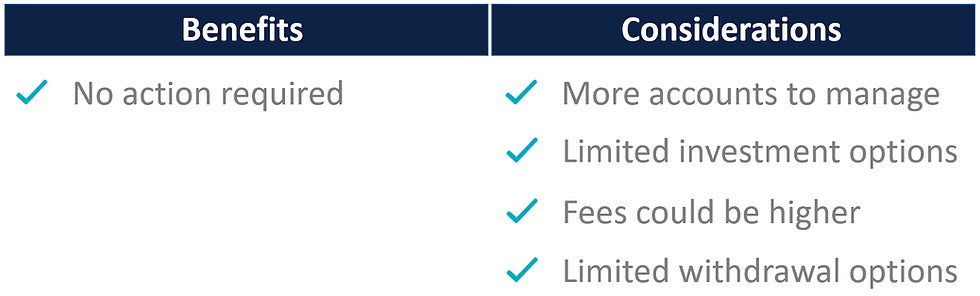

Keep account where it is.

If your balance is more than $5,000, most companies will let you keep your balance with their Plan. While you will no longer be making contributions, your balance will continue to grow based on the investments you have chosen. While you do not have to move the balance, you could be subjecting yourself to higher Plan and/or investment fees while limiting yourself to inferior investment options.

Bring account with you.

In most cases, you can consolidate your old Plan balance into your current employer’s Plan. The consolidated balances will continue to grow based on the investments you have chosen in this new plan. When comparing your old and new Plans, you should determine which Plan offers the best investment options and understand the difference in Plan and investment fees. At the end of the day, which Plan gives you the best opportunity to grow your balance?

Rollover account to an IRA.

Over time, it is common for investors to end up with several old Plans at separate record keepers (custodians). For ease of management, most investors choose to consolidate their retirement account balances into a single retirement account – an IRA. In an IRA, you will have virtually unlimited investment options and far more control over your fees. When managed properly, having more options and control usually means better performance, which means more for your bottom line. Leaning on a financial professional to assist in investment selection and management will allow you to focus on saving, so you can reach your goals that much faster.

Make the best decision for YOU.

There is no one-size-fits-all answer to this question. There are factors to consider that are unique to each situation which means that the best choice will be different for everyone. If you find it overwhelming or confusing, speak with a fiduciary advisor to help with your decision. The sooner you know which option is best for you, the sooner your money can be working for you in the best way possible.

Frank Iozzo, CPWA®

President, Private Wealth Advisor

Did you find this helpful? Let us know in the comments and share it with someone you know.